It’s probably no surprise to anyone that the number of dual-income households has grown dramatically over the past 40+ years. Today, the majority of American households are dual-income, with modern families looking significantly different than those of previous generations.

Unfortunately, the tools and financial institutions haven’t kept up as household makeup and finances have become more complicated. Consumer needs have changed into what this week’s Fintech Growth Talk guest calls “multiplayer mode,” where households have multiple people involved in earning and spending money. Aditi Shekar, founder and CEO of Zeta, says that today’s household earners are siblings, spouses, parents, grandparents, and not just a father or single-parent earner households of just a few decades ago.

In fact, the lack of tools and support for modern families is what led Shekar to found Zeta. The idea sprang from her own personal experiences in college and with her partner. Shekar and her now husband faced a number of emotional and practical challenges to jointly managing money when they first moved in together. She realized that they had both simple and complex financial decisions to make, ranging from if they should combine finances, who pays which bills from which account, how they should be using their debit cards, and several others.

Shekar looked for tools and resources to help them manage their particular situation, but found few that suited the young couple’s needs. And after talking to a number of friends in similar situations, as well as leading personal financial workshops at General Assembly, she found that most couples were hacking together clunky solutions with spreadsheets and services like Venmo.

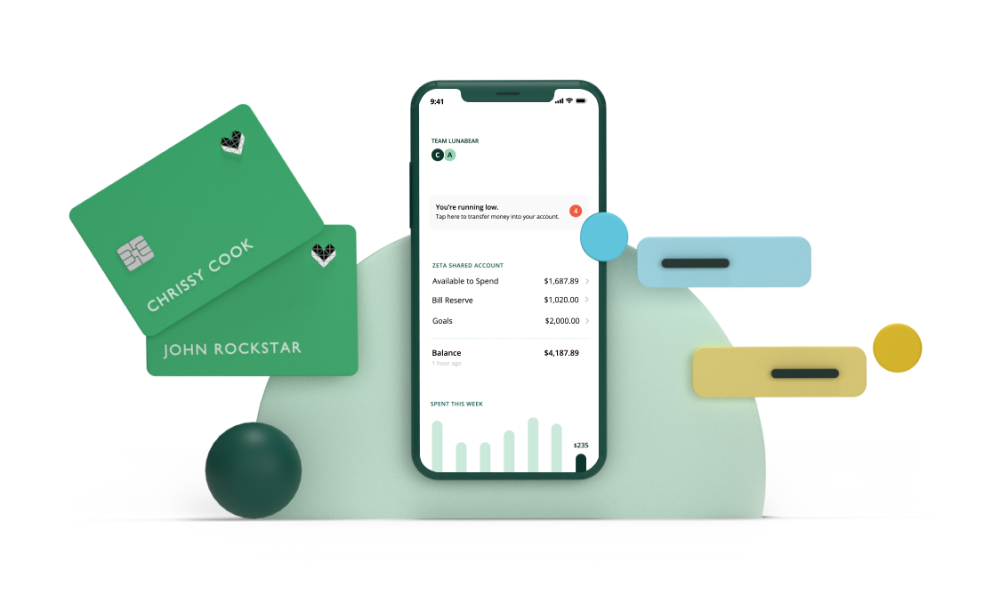

Ultimately, this led to Zeta, which aims to provide an exceptional financial experience to help multiplayer households coordinate and manage their money. Starting with finances for couples, Zeta delivers tools that help families make and execute better financial decisions.

At the root of this, Shekar believes, is providing a level of transparency that’s hard to find elsewhere but is something today’s couples expect out of financial products. With Zeta, couples can gain exposure to each other’s finances, enabling them to have more open and clear conversations about how they manage their household expenses.

“We want [couples] to be more successful about money as a team,” says Shekar.

Shekar believes Zeta is on a path to providing more robust products for multiplayer households, with a recently rolled out debit card designed specifically for couples. But, she says, it’s essential to remain thoughtful of what their products can and should do.

She encourages other fintech founders to get smart about their users, who their target customer is, and what they want to accomplish. What’s more, fintechs need to be clear on the rules, regulations, and policies governing their operations.

For this reason, she’s a strong proponent of fintech’s community of founders, which has provided her with a lot of support and insights. She says she talks with fellow founders regularly, brainstorming solutions to common in the industry challenges.

About Aditi Shekar

Aditi Shekar has been obsessing about personal finance ever since she got her first paycheck. She has spent 12+ years at the ground floor of two venture-backed startups (General Assembly, Guild Education) and served as Executive Director at Ashoka, a leading social entrepreneurship organization. She’s also a family finance expert at publications like Refinery29, Business Insider & Real Simple. Aditi has a BS/BA in Business & Psychology from UNC Chapel Hill.

Listen to our full interview with Aditi Shekar here:

0

0